Morning all,

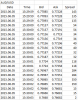

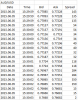

I had a bad time trading the non farm payrolls on the AUD/USD last week but that's forex for you . When I queried the spreads with customer support I got the following list of bids/ask prices:

. When I queried the spreads with customer support I got the following list of bids/ask prices:

Yes that's right there's a spread of 350 pips in there!

I'm not going to name the broker as I just want to know if anyone has an MT4 addon that calculates spreads etc or also came across spreads like this. I'm on an ECN account and expected wider spreads during the news but this is a new personal best. Never had any issues with this broker for over a year and still think they offer good service but I'm questioning the authenticity of their ECN account.

I had a bad time trading the non farm payrolls on the AUD/USD last week but that's forex for you

Yes that's right there's a spread of 350 pips in there!

I'm not going to name the broker as I just want to know if anyone has an MT4 addon that calculates spreads etc or also came across spreads like this. I'm on an ECN account and expected wider spreads during the news but this is a new personal best. Never had any issues with this broker for over a year and still think they offer good service but I'm questioning the authenticity of their ECN account.