- Joined

- 30 June 2021

- Posts

- 24

- Reactions

- 19

Hi there, I'm going to post here daily, for a few weeks, my AI generated predictions for the ASX200 components.

For example, if today is Friday, today's MA5 will be calculated over the most recent 5 days (Mon-Tue-Wed-Thu-Fri) and the prediction will be the percentage change in MA5 today vs MA5 calculated next Friday.

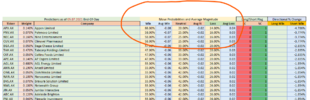

The primary components are summarised in a single figure [Directional % Change] to give the statistical magnitude of the predicted change + for Increase and - for Decrease.

R2 Score is 0.34348

I attach here the prediction file I've generated yesterday after the close just to be used as an example. I'll post again today after the close when todays EOD is available.

Note: I don't give any promises regarding those predictions, investment in stock market is a high risk activity and majority of short term traders lose in the long run.

Cheers.

- What data is used?

- What is predicted?

For example, if today is Friday, today's MA5 will be calculated over the most recent 5 days (Mon-Tue-Wed-Thu-Fri) and the prediction will be the percentage change in MA5 today vs MA5 calculated next Friday.

- How to read the prediction?

The primary components are summarised in a single figure [Directional % Change] to give the statistical magnitude of the predicted change + for Increase and - for Decrease.

- What is the algorithm used?

- How big is the data used for training / testing the ML algorithm?

- What R-squared did you get on the validation data?

R2 Score is 0.34348

- How often will you be posting the predictions

- Why am I doing this?

I attach here the prediction file I've generated yesterday after the close just to be used as an example. I'll post again today after the close when todays EOD is available.

Note: I don't give any promises regarding those predictions, investment in stock market is a high risk activity and majority of short term traders lose in the long run.

Cheers.