- Joined

- 28 March 2006

- Posts

- 3,576

- Reactions

- 1,335

These guys don't like it when they get hit.

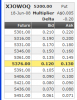

Below is the current bid/ask for a CitiWarrants put warrant on the XJO (XJOWOQ) as well as their pricing matrix for today, ie. what the bid ask should be.

I rang them up and complained about their bid distance from the market and the response was that they are having difficulty maintaining the price because the warrant is close to expiry (18th June)

Their bid should be about 0.205, not 0.185, it makes a big difference to the profit if you are selling, of course if you want to buy there are none available.

Its hard enough without this nonsense.

Below is the current bid/ask for a CitiWarrants put warrant on the XJO (XJOWOQ) as well as their pricing matrix for today, ie. what the bid ask should be.

I rang them up and complained about their bid distance from the market and the response was that they are having difficulty maintaining the price because the warrant is close to expiry (18th June)

Their bid should be about 0.205, not 0.185, it makes a big difference to the profit if you are selling, of course if you want to buy there are none available.

Its hard enough without this nonsense.