Hi All,

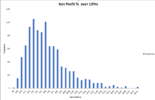

I have attached the strategy backtest report from Amibroker for a monthly strategy I am working on.

Whilst the results look promising, I wanted to get feedback on the stats, where you see issues.

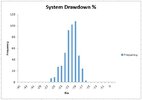

I am concerned about the Monte carlo analysis.

I donot fully understand on how to interpret Monte carlo analysis results. But i do see a lot of zeroes in there

So, would like some help from the experienced. Is it a risk to trade this system as is?

PS: I had to attach the report in zip format as HTML attachments are not accepted. Let me know if you are concerned with opening zip files. I will attach image files.

Regards,

Hari

I have attached the strategy backtest report from Amibroker for a monthly strategy I am working on.

Whilst the results look promising, I wanted to get feedback on the stats, where you see issues.

I am concerned about the Monte carlo analysis.

I donot fully understand on how to interpret Monte carlo analysis results. But i do see a lot of zeroes in there

So, would like some help from the experienced. Is it a risk to trade this system as is?

PS: I had to attach the report in zip format as HTML attachments are not accepted. Let me know if you are concerned with opening zip files. I will attach image files.

Regards,

Hari