Hi all,

Been back testing a trend system and have 3 questions:

1. Would you trade the system with the following back-test results?

2. How far back would you look with respect to historical data? (As you can see my result are not so flash pre-2000)

3. What other factors would you consider before making a decision to trade it ?

Disclaimer - This is my first system, I know it is not perfect, but keen to get started

My in-sample dataset has been from 1/1/2000 to 31/12/2003 - this includes 1 bear year and 3 bull.

Results are below:

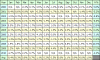

2000-2003 (average results)

CAR = 33.9%

MaxDD = 22.8%

% Win = 41.6%

% Loser = 58.4%

Other criteria ???

2004-2010 (now) (average results)

CAR = 29.4%

MaxDD = 31.9%

% Win = 38.3%

% Loser = 61.7%

Other criteria ???

1992-2000 (average results)

CAR = 5.5%

MaxDD = 29.9%

% Win = 35.8%

% Loser = 64.2%

Other criteria ???

Results do not include any commissions.

Been back testing a trend system and have 3 questions:

1. Would you trade the system with the following back-test results?

2. How far back would you look with respect to historical data? (As you can see my result are not so flash pre-2000)

3. What other factors would you consider before making a decision to trade it ?

Disclaimer - This is my first system, I know it is not perfect, but keen to get started

My in-sample dataset has been from 1/1/2000 to 31/12/2003 - this includes 1 bear year and 3 bull.

Results are below:

2000-2003 (average results)

CAR = 33.9%

MaxDD = 22.8%

% Win = 41.6%

% Loser = 58.4%

Other criteria ???

2004-2010 (now) (average results)

CAR = 29.4%

MaxDD = 31.9%

% Win = 38.3%

% Loser = 61.7%

Other criteria ???

1992-2000 (average results)

CAR = 5.5%

MaxDD = 29.9%

% Win = 35.8%

% Loser = 64.2%

Other criteria ???

Results do not include any commissions.