Fox

Whale, shark, eel, plankton

- Joined

- 15 August 2009

- Posts

- 187

- Reactions

- 0

I have a lot of questions which are XJO specific, and thought of putting this thread together for those sharing an interest in XJO. The first question I have is regarding XJO historical volatility.

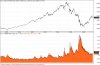

The graph below is the 30 day HV of XJO going back almost 4 years, which I obtained using the Hoadley tool. My understanding is that HV's are mean reverting. The problem of course is determining what the mean should be. The mean will vary depending on how far back in time you look.

My opinion is that the peaks before March 08 and before Dec 08 can be discounted as extra-ordinary events ie. black swans. Ignoring those two peaks, HV lies somewhere between 8% to 30%. From visual inspection, I would probably call 15% as the mean HV.

It would be great to hear the opinion of others. There's probably no right answer, but the more opinion we have, the more we can think/consider, before coming to our own conclusions. So, what do you think the mean HV is?

The graph below is the 30 day HV of XJO going back almost 4 years, which I obtained using the Hoadley tool. My understanding is that HV's are mean reverting. The problem of course is determining what the mean should be. The mean will vary depending on how far back in time you look.

My opinion is that the peaks before March 08 and before Dec 08 can be discounted as extra-ordinary events ie. black swans. Ignoring those two peaks, HV lies somewhere between 8% to 30%. From visual inspection, I would probably call 15% as the mean HV.

It would be great to hear the opinion of others. There's probably no right answer, but the more opinion we have, the more we can think/consider, before coming to our own conclusions. So, what do you think the mean HV is?

is not XJO specific but it can be.

is not XJO specific but it can be.