Hi All,

I am a newbie playing around with Amibroker and running some Monte Carlo Tests, but but my results look nothing like what I have seen other people post. I am using the latest 64bit version 6.10 .

I am not sure if its me doing something wrong or simply a terrible AFL.

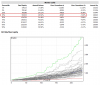

For example, if you look at the equity graph posted : https://www.amibroker.com/guide/h_montecarlo.html you will see Green/Red and a number of Grey lines:

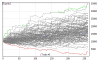

When I run a monte carlo I get no grey lines at all see the attached... I am not sure if the issue is with my coding or my monte carlo settings etc....

thanks

JJZ

I am a newbie playing around with Amibroker and running some Monte Carlo Tests, but but my results look nothing like what I have seen other people post. I am using the latest 64bit version 6.10 .

I am not sure if its me doing something wrong or simply a terrible AFL.

For example, if you look at the equity graph posted : https://www.amibroker.com/guide/h_montecarlo.html you will see Green/Red and a number of Grey lines:

When I run a monte carlo I get no grey lines at all see the attached... I am not sure if the issue is with my coding or my monte carlo settings etc....

thanks

JJZ

Should help me put together a more robust system in the long term.

Should help me put together a more robust system in the long term.