- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,884

I am looking at creating a scan in AmiBroker using Fundamental Data provided by Norgate and having no real idea about FA I was hoping that we could pool our knowledge together and create a basic scan that can be incorporated into our own system.

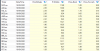

So far I have the following information extracted out of Norgate and displayed in AmiBroker.

Small snip of the above exploration

Now the million dollar question is "What to Do With This Information"

I am thinking about creating some filters for the following

1. Return of Equity > 14

2. Shares Out < 1 billion

3. Forward Dividend > 4%

4. ?????

Hopefully some of you are interested in the above and can provide your thoughts, and if you are not AmiBroker savvy I am still interested in what you have to say so please fire away and lets see what we can put together.

Thanks

Trav

So far I have the following information extracted out of Norgate and displayed in AmiBroker.

Code:

Filter = 1;

AddColumn( Close, "Close");

AddColumn( GetFnData("SharesOut"), " SharesOut", 1, colorDefault, colorDefault, 90); // Number of shares outstanding

AddColumn( GetFnData("SharesFloat"), "SharesFloat ", 1, colorDefault, colorDefault, 90); // Number of shares outstanding that are freely available for trading ("Free Float")

AddColumn( GetFnData("Beta"), "Beta "); // A measure of a stock's price volatility relative to the market

AddColumn( GetFnData("EPS"), "EPS "); // EPS excluding extraordinary items - trailing 12 month

AddColumn( GetFnData("EPSEstCurrentYear"), "EPSEstCurrentYear "); // Current Consensus for EPS

AddColumn( GetFnData("BookValuePerShare"), "BookValuePerShare "); // Book value per share - most recent quarter

AddColumn( GetFnData("ProfitMargin"), "ProfitMargin "); // Net Profit Margin % - trailing 12 month

AddColumn( GetFnData("OperatingMargin"), "OperatingMargin "); // Operating margin - trailing 12 month

AddColumn( GetFnData("OneYearTargetPrice"), "OneYearTargetPrice "); // Current Consensus Target Price

AddColumn( GetFnData("ReturnOnAssets"), "ReturnOnAssets "); // Return on average assets - trailing 12 month

AddColumn( GetFnData("ReturnOnEquity"), "ReturnOnEquity "); // Return on average equity - trailing 12 month

AddColumn( GetFnData("QtrlyRevenueGrowth"), "QtrlyRevenueGrowth "); // Revenue Change % - most recent quarter 1 year ago

AddColumn( GetFnData("SalesPerShare"), "SalesPerShare "); // Revenue per share - trailing 12 month

AddColumn( GetFnData("EBITDAPerShare"), "EBITDAPerShare "); // EBITD per share - trailing 12 month

AddColumn( GetFnData("QtrlyEarningsGrowth"), "QtrlyEarningsGrowth "); // EPS Change % - most recent quarter vs corresponding 1 year ago

AddColumn( GetFnData("DividendPerShare"), "DividendPerShare "); // Trailing 12 month sum of all split-adjusted ordinary dividends

AddColumn( GetFnData("ForwardDividendPerShare"), "ForwardDividendPerShare "); // Current Consensus for Dividend Per Share

AddColumn( GetFnData("LastSplitDate"), "LastSplitDate "); // The ex-date of the last share split or reverse split (consolidation)

AddColumn( GetFnData("LastSplitRatio"), "LastSplitRatio "); // The ratio of new shares to old in the last split

AddColumn( GetFnData("DividendPayDate"), "DividendPayDate "); // Payment date for the current dividend

AddColumn( GetFnData("ExDividendDate"), "ExDividendDate "); // Ex-dividend date for the current dividend

AddColumn( GetFnData("DelistingDate"), "DelistingDate "); // The last day that the security was available for trading before delistingSmall snip of the above exploration

Now the million dollar question is "What to Do With This Information"

I am thinking about creating some filters for the following

1. Return of Equity > 14

2. Shares Out < 1 billion

3. Forward Dividend > 4%

4. ?????

Hopefully some of you are interested in the above and can provide your thoughts, and if you are not AmiBroker savvy I am still interested in what you have to say so please fire away and lets see what we can put together.

Thanks

Trav