You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Joined

- 1 June 2013

- Posts

- 278

- Reactions

- 15

Re: AGK, ORG, OMG!!!!

What was your thinking behind purchasing these particular shares?

Do you have other holdings or are you limited to just these?

Have you established a strategy for yourself?

Have you got your end goal as to why you are investing?

Once you know what you are setting yourself out to achieve, thats when things become easier. The pain of decreases become minor blips, and the joy of getting closer to your end goal are realised.

Perhaps this may encourage you to further your understanding of the markets. Hang around, search, read heaps, search, ask questions, search!

pinkboy

What was your thinking behind purchasing these particular shares?

Do you have other holdings or are you limited to just these?

Have you established a strategy for yourself?

Have you got your end goal as to why you are investing?

Once you know what you are setting yourself out to achieve, thats when things become easier. The pain of decreases become minor blips, and the joy of getting closer to your end goal are realised.

Perhaps this may encourage you to further your understanding of the markets. Hang around, search, read heaps, search, ask questions, search!

pinkboy

Re: AGK, ORG, OMG!!!!

Hi PinkBoy, Thems there seem very wise words. Thank you. I`m playing with some of my Super since I wasnt getting much of a result by leaving the CEO`S of host-plus manage it. Hmmm, what was I wanting? Just a bit of a return instead of seeing minuses for " admin fees " etc. I guess thats not an easy task.

Its a shame because I have put a lot of research into 25 different asx200 companies and half of them have performed very well in the past three months ( i guess thats not a lot of research really is it ). These two companies seem to be in a downward spiral this past week. Is it not typical of me as a newby to just go ahead and fear the worst.

Hi PinkBoy, Thems there seem very wise words. Thank you. I`m playing with some of my Super since I wasnt getting much of a result by leaving the CEO`S of host-plus manage it. Hmmm, what was I wanting? Just a bit of a return instead of seeing minuses for " admin fees " etc. I guess thats not an easy task.

Its a shame because I have put a lot of research into 25 different asx200 companies and half of them have performed very well in the past three months ( i guess thats not a lot of research really is it ). These two companies seem to be in a downward spiral this past week. Is it not typical of me as a newby to just go ahead and fear the worst.

- Joined

- 30 July 2013

- Posts

- 8

- Reactions

- 1

Re: AGK, ORG, OMG!!!!

Hi GBO,

I'm quite new myself and can tell you the questions Pinkboy is asking will help you greatly. Not easy to truly answer though.

Personally i have found i like momentum investing - the numbers give me the information I'm after & i have gone onto a low information diet when it comes to expert opinion. The people on this site excepted as those that have been here a while seem to hold a lot of hard earned wisdom & aren't just making noise for the sake of being heard.

So far i am in the black (just) but having fun and learning heaps. I enjoy investing much more since I started following (strictly) a risk assessment strategy. Moneyball also helped - right now I'm trying to get on base rather than hit a home run. I think if I get good at getting on base the runs will start to flow.

Hi GBO,

I'm quite new myself and can tell you the questions Pinkboy is asking will help you greatly. Not easy to truly answer though.

Personally i have found i like momentum investing - the numbers give me the information I'm after & i have gone onto a low information diet when it comes to expert opinion. The people on this site excepted as those that have been here a while seem to hold a lot of hard earned wisdom & aren't just making noise for the sake of being heard.

So far i am in the black (just) but having fun and learning heaps. I enjoy investing much more since I started following (strictly) a risk assessment strategy. Moneyball also helped - right now I'm trying to get on base rather than hit a home run. I think if I get good at getting on base the runs will start to flow.

Re: AGK, ORG, OMG!!!!

Thanks Far Ken for the re-assurance and encouragement. Reading some of the threads here it seems like a whole new world out here and I love new worlds, challenges. Am I the only one that is absolutely gobsmacked at the downward spiral these two energy companies are showing? OMG every day I check the fluctuations and see the downfalls continue to drop I just lose confidence all together.

Thanks Far Ken for the re-assurance and encouragement. Reading some of the threads here it seems like a whole new world out here and I love new worlds, challenges. Am I the only one that is absolutely gobsmacked at the downward spiral these two energy companies are showing? OMG every day I check the fluctuations and see the downfalls continue to drop I just lose confidence all together.

- Joined

- 17 August 2006

- Posts

- 7,739

- Reactions

- 8,332

Re: AGK, ORG, OMG!!!!

GBO, I would not be so presumptuous as to try and give you advice, but just a couple of things which maybe worth considering ....

The aussie market in general at the time you invested had been experiencing a sustained uptrend, ..... but the momentum of that uptrend was decreasing ........ (caution)

Buying any Stock near its medium term highs when the overall market is starting to stall is potentially risky (caution)

The old adage for Stock Investing .. Buy when there is blood on the streets, and Sell when everyone is cheering how wonderful the world looks!

Perhaps studying the pros and cons of technical analysis could be beneficial, although there is no guarantee that will stop the same thing happening in the future ...

...

Assuming you have only lost a small percentage of your overall net worth, treat it as a valuable learning experience

If I was to give any advice (which I am not allowed to), don't let your current bleeding turn into a haemorrhage!!

Good luck with it.

Am I the only one that is absolutely gobsmacked at the downward spiral these two energy companies are showing? OMG every day I check the fluctuations and see the downfalls continue to drop I just lose confidence all together.

GBO, I would not be so presumptuous as to try and give you advice, but just a couple of things which maybe worth considering ....

The aussie market in general at the time you invested had been experiencing a sustained uptrend, ..... but the momentum of that uptrend was decreasing ........ (caution)

Buying any Stock near its medium term highs when the overall market is starting to stall is potentially risky (caution)

The old adage for Stock Investing .. Buy when there is blood on the streets, and Sell when everyone is cheering how wonderful the world looks!

Perhaps studying the pros and cons of technical analysis could be beneficial, although there is no guarantee that will stop the same thing happening in the future

Assuming you have only lost a small percentage of your overall net worth, treat it as a valuable learning experience

If I was to give any advice (which I am not allowed to), don't let your current bleeding turn into a haemorrhage!!

Good luck with it.

Re: AGK, ORG, OMG!!!!

Why has energy taken such a hit lately. Carbon tax has been axed, solar feed-in tarrifs were dramatically decreased years ago. KWh rates are still increasing faster than the mars probe launcher rockets. Whats going on? CEO`s got their hands in too deep, again?

Why has energy taken such a hit lately. Carbon tax has been axed, solar feed-in tarrifs were dramatically decreased years ago. KWh rates are still increasing faster than the mars probe launcher rockets. Whats going on? CEO`s got their hands in too deep, again?

- Joined

- 28 March 2006

- Posts

- 3,554

- Reactions

- 1,283

Re: AGK, ORG, OMG!!!!

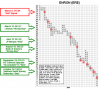

I don't see a downward spiral, I just see a stock that is trading sideways in a constant cycle.

Did you expect it to do something different because you bought it ?

Copy this post and fill in answers to the the questions below.

1. What is my entry point (price) and why ?

A.

2. What is my share price expectation and why ?

A.

3. Why did I pick this stock from the 2000+ that are trading on the ASX.

A.

4. Where should I set my Stop Loss in case I have got it wrong ?

A.

5. How much of my capital am I prepared to risk should I be wrong.

A.

Sorry if I seem abrupt with my post but if you can't answer these questions you are probably better off going on red at the local casino.

PS. Note that I have highlighted something that is missing in this discussion so far.

Chart of AGK below.

...

Am I the only one that is absolutely gobsmacked at the downward spiral these two energy companies are showing? OMG every day I check the fluctuations and see the downfalls continue to drop I just lose confidence all together.

I don't see a downward spiral, I just see a stock that is trading sideways in a constant cycle.

Did you expect it to do something different because you bought it ?

Copy this post and fill in answers to the the questions below.

1. What is my entry point (price) and why ?

A.

2. What is my share price expectation and why ?

A.

3. Why did I pick this stock from the 2000+ that are trading on the ASX.

A.

4. Where should I set my Stop Loss in case I have got it wrong ?

A.

5. How much of my capital am I prepared to risk should I be wrong.

A.

Sorry if I seem abrupt with my post but if you can't answer these questions you are probably better off going on red at the local casino.

PS. Note that I have highlighted something that is missing in this discussion so far.

Chart of AGK below.

Attachments

- Joined

- 17 August 2006

- Posts

- 7,739

- Reactions

- 8,332

Re: AGK, ORG, OMG!!!!

LOL .... Good on ya

I recall when I started trading, I gave more blood than I care to remember

You can never assume a "good stock" will return to being good

Cheers.

Thanks for the advice Barns. I have never donated blood and am not interested in starting now.

LOL .... Good on ya

I recall when I started trading, I gave more blood than I care to remember

You can never assume a "good stock" will return to being good

Cheers.

- Joined

- 17 August 2006

- Posts

- 7,739

- Reactions

- 8,332

Re: AGK, ORG, OMG!!!!

Just on those points ....... Fundamentals are the health of a Company for sure, but bear in mind that the fundamentals have usually been assimilated into the Price Chart by the time we Retailers have been informed .

.

Why has energy taken such a hit lately. Carbon tax has been axed, solar feed-in tarrifs were dramatically decreased years ago. KWh rates are still increasing faster than the mars probe launcher rockets. Whats going on? CEO`s got their hands in too deep, again?

Just on those points ....... Fundamentals are the health of a Company for sure, but bear in mind that the fundamentals have usually been assimilated into the Price Chart by the time we Retailers have been informed

.

.So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

Re: AGK, ORG, OMG!!!!

ITS TIMING!

My quotes below from the ORG thread November 2012 + 3 year chart proving my point...12th November 2012 marked in red.

https://www.aussiestockforums.com/forums/showthread.php?t=1946&page=5&p=736942&viewfull=1#post736942

Very new to investing but it feels like gambling to me, and as always, I LOSE.

AGK and ORG shares that I bought into 3 months ago are almost done and dusted? Is it solar killing it? Govt fees?? Who knows.

ITS TIMING!

My quotes below from the ORG thread November 2012 + 3 year chart proving my point...12th November 2012 marked in red.

(12th-November-2012) Yep its about time to jump in id reckon.

https://www.aussiestockforums.com/forums/showthread.php?t=1946&page=5&p=736942&viewfull=1#post736942

~(12th-November-2012) Yer but the growth will come, i mean the SP wont just stay at the current level...Gas and energy retailing, it has natural demand and inflation growth built in.

Attachments

Re: AGK, ORG, OMG!!!!

Wow, 12 Nov 2012. Looks pretty scary.

Anyhow,

1. What is my entry point (price) and why ?

A. 11-Apr-2014 Buying 110 AGK.AU @ AUD15.205

2. What is my share price expectation and why ?

A. AUD15.205.999 ( at least enough to cover the tax that the govt steals.

3. Why did I pick this stock from the 2000+ that are trading on the ASX.

A. Electricity costs have risen excessively and continue to rise excessively why would`nt one choose this stock?

4. Where should I set my Stop Loss in case I have got it wrong ?

A. My stop loss is the same as it was when my super fund had control ( 100% ). I have not got access to it now and I certainly dont think i will have access to it when the govt/super fund ceo`s feel it is ok to release it. ie. 65-100 years of age??? Same thing. No use to me at those ages.

5. How much of my capital am I prepared to risk should I be wrong.

A. 100%.

Wow, 12 Nov 2012. Looks pretty scary.

Anyhow,

1. What is my entry point (price) and why ?

A. 11-Apr-2014 Buying 110 AGK.AU @ AUD15.205

2. What is my share price expectation and why ?

A. AUD15.205.999 ( at least enough to cover the tax that the govt steals.

3. Why did I pick this stock from the 2000+ that are trading on the ASX.

A. Electricity costs have risen excessively and continue to rise excessively why would`nt one choose this stock?

4. Where should I set my Stop Loss in case I have got it wrong ?

A. My stop loss is the same as it was when my super fund had control ( 100% ). I have not got access to it now and I certainly dont think i will have access to it when the govt/super fund ceo`s feel it is ok to release it. ie. 65-100 years of age??? Same thing. No use to me at those ages.

5. How much of my capital am I prepared to risk should I be wrong.

A. 100%.

- Joined

- 28 March 2006

- Posts

- 3,554

- Reactions

- 1,283

Re: AGK, ORG, OMG!!!!

Q1 and Q2 ok

Q4 and Q5, not even going there !

Q3, a quick off the the top of my head response.

SKI, has more than double the dividend, EPS, and ROA and there's probably a few other fundamentals too. Technically, the chart is in an uptrend.

SKI weekly chart

Wow, 12 Nov 2012. Looks pretty scary.

Anyhow,

1. What is my entry point (price) and why ?

A. 11-Apr-2014 Buying 110 AGK.AU @ AUD15.205

2. What is my share price expectation and why ?

A. AUD15.205.999 ( at least enough to cover the tax that the govt steals.

3. Why did I pick this stock from the 2000+ that are trading on the ASX.

A. Electricity costs have risen excessively and continue to rise excessively why would`nt one choose this stock?

4. Where should I set my Stop Loss in case I have got it wrong ?

A. My stop loss is the same as it was when my super fund had control ( 100% ). I have not got access to it now and I certainly dont think i will have access to it when the govt/super fund ceo`s feel it is ok to release it. ie. 65-100 years of age??? Same thing. No use to me at those ages.

5. How much of my capital am I prepared to risk should I be wrong.

A. 100%.

Q1 and Q2 ok

Q4 and Q5, not even going there !

Q3, a quick off the the top of my head response.

SKI, has more than double the dividend, EPS, and ROA and there's probably a few other fundamentals too. Technically, the chart is in an uptrend.

SKI weekly chart

Attachments

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

Re: AGK, ORG, OMG!!!!

1. Should i be buying this stock now (timing)

A. November 2012 = yes (clearly the best time/month to buy over the last 36 months)

This is the only question to ask, if its not a great time to buy you never need to ask the next question.

Wow, 12 Nov 2012. Looks pretty scary.

Anyhow,

1. What is my entry point (price) and why ?

A. 11-Apr-2014 Buying 110 AGK.AU @ AUD15.205

.

1. Should i be buying this stock now (timing)

A. November 2012 = yes (clearly the best time/month to buy over the last 36 months)

This is the only question to ask, if its not a great time to buy you never need to ask the next question.

- Joined

- 28 March 2006

- Posts

- 3,554

- Reactions

- 1,283

Re: AGK, ORG, OMG!!!!

And then there's...

1. Should i be buying this stock now (timing)

A. November 2012 = yes (clearly the best time/month to buy over the last 36 months)

This is the only question to ask, if its not a great time to buy you never need to ask the next question.

And then there's...

Attachments

So_Cynical

The Contrarian Averager

- Joined

- 31 August 2007

- Posts

- 7,464

- Reactions

- 1,463

Re: AGK, ORG, OMG!!!!

Is it a great time to buy XYZ? its a question that covers so many aspects, so many unknowns and so many knowns, take stock of the big picture and make a decision, different to the trendy's that only look at price moment.

I have a near perfect record in avoiding the total disasters...just the one 100% er...countered by 6 x 100%+ ers.

And then there's...

Is it a great time to buy XYZ? its a question that covers so many aspects, so many unknowns and so many knowns, take stock of the big picture and make a decision, different to the trendy's that only look at price moment.

I have a near perfect record in avoiding the total disasters...just the one 100% er...countered by 6 x 100%+ ers.