Starting a new thread on this topic to not clutter the other thread:

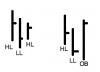

Here's a signalling system I wrote, it uses Ichimoku for S/R zone (Ichimoku lines aren't the same as a moving average, look them up if you don't know what they are).

Not every arrow is a signal. You take arrows that line up with S/R (previous lows and highs). For longs, signals around previous lows are more significant though you can trade RbS signals. For shorts, signals around previous highs are more significant, though you can trade SbR signals. For the RbS/SbR it is probably best to adjust the position for volatility or trade half size. You can enter long using stops at the high or limits at the low depending on your belief in how the market works (converse for shorts).

The formula is based on one which is widely known, even published on the internet, I think if you googled "swing trading" it would be in the top 3 hits. Designed for stocks but whatever. I just use Ichimoku instead of MAs.

Here are clean 4 hour charts with the signalling software enabled for the forex majors. Sorry about the EURUSD chart being more zoomed in, I've been messing with the tick database and managed to break it somehow so zoomed into where the signals are accurate.

The code is raw, it isn't perfect. It misses a lot of trades I would have taken, but it does give you an idea.

I am posting this code only for illustration and discussion purposes. It is free of charge, assuming you don't rip it off and try to sell it or something. If you like it, and run a hedge fund needing a compsci geek, hire me!

:

:

Im interested in the formula for identifying swing trading in a system

You wouldnt happen to be able to post it would you?

Neer been able to find one.That Works.

Here's a signalling system I wrote, it uses Ichimoku for S/R zone (Ichimoku lines aren't the same as a moving average, look them up if you don't know what they are).

Not every arrow is a signal. You take arrows that line up with S/R (previous lows and highs). For longs, signals around previous lows are more significant though you can trade RbS signals. For shorts, signals around previous highs are more significant, though you can trade SbR signals. For the RbS/SbR it is probably best to adjust the position for volatility or trade half size. You can enter long using stops at the high or limits at the low depending on your belief in how the market works (converse for shorts).

The formula is based on one which is widely known, even published on the internet, I think if you googled "swing trading" it would be in the top 3 hits. Designed for stocks but whatever. I just use Ichimoku instead of MAs.

Here are clean 4 hour charts with the signalling software enabled for the forex majors. Sorry about the EURUSD chart being more zoomed in, I've been messing with the tick database and managed to break it somehow so zoomed into where the signals are accurate.

The code is raw, it isn't perfect. It misses a lot of trades I would have taken, but it does give you an idea.

I am posting this code only for illustration and discussion purposes. It is free of charge, assuming you don't rip it off and try to sell it or something. If you like it, and run a hedge fund needing a compsci geek, hire me!

Code:

while( i >= 0 )

{

double ts = iIchimoku(NULL,0,9,26,52,MODE_TENKANSEN,i);

double ks = iIchimoku(NULL,0,9,26,52,MODE_KIJUNSEN,i);

double sa = iIchimoku(NULL,0,9,26,52,MODE_SENKOUSPANA,i);

double sb = iIchimoku(NULL,0,9,26,52,MODE_SENKOUSPANB,i);

double wpr = iWPR(NULL,0,6,i+1);

double wpr2 = iWPR(NULL,0,6,i+2);

//SHORT

if (ts < ks && (High[i] < High[i+1] || (High[i] > High[i+1] && Low[i] < Low[i+1] && Close[i] < Close[i+1])) && High[i+1] > High[i+2] && Close[i+1] < ks && Close[i+1] > ts && Close[i] < sa && Close[i] < sb && (wpr > - 20 || wpr2 > -20)){

hi[i] = High[i] + BasePips(DistanceFromCandle) * Point;

}

else

{

hi[i] = 0;

}

//LONG

if (ts > ks && (Low[i] > Low[i+1] || (Low[i] < Low[i+1] && High[i] > High[i+1] && Close[i] > Close[i+1])) && Low[i+1] < Low[i+2] && Close[i+1] > ks && Close[i+1] < ts && Close[i] > sa && Close[i] > sb && (wpr < -80 || wpr2 < -80))

{

lo[i] = Low[i] - BasePips(DistanceFromCandle) * Point;

}

else

{

lo[i] = 0;

}