- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

TO BE HONEST .... I'M not a real time trader ..... and about 2 posts today intraday .. The purpose was to show the importance of Multiple Resistance .... or Test areas on a given market chart ... The same things that are being highlighted End of Day and Weekly charts ,also happen in Real Time ......

My Trading Style ?

#1 Find multiple support areas on ..... Weekly and Monthly charts ....

( They will be more reliable, than on Daily or Intraday charts because of

what's called Market Noise... that occurs Intraday ... )

# 2 Buy , when a market is sitting on what appears to be multiple support and coordinate this with Fibbonacci Retracement levels...

(If .. you don't know what a Fibonacci Retracement level is THEN

Resaerch this topic on your own,,, )

# 3 ,, STAY AWAY FROM BREAK - OUTS ,

ITS TOO LATE !

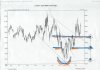

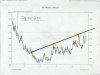

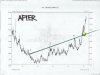

To sum this all up ,,,, What I look for Visually, in all of this , is for a break- out through a resistance line and the a pullback..

(BULLISH SENERIO )

When I say pullback ,,, it also means TEST ,.......

Or in other words , the retest of an old resistance line ....

Because ,that's what it appears to be doing... which is retesting the old Resistance line area ..

BREAK-OUT THEN THE PULLBACK ... (TEST AREA )

This theory is no diffrent than traders who make momentum plays off of lets say a 20 day or 50 day moving averegaes ....Just look at Google is in a strong uptrend .... any dip below a 20 0r 50 day average ,, because its in a strong uptrend,,,,, it presents itself as support to the seasoned trader ... they are basically looking for a pull back in price off of recent strength in a given market .

SO WHAT I AM LOOKING FOR IS ONE OF THESE 2 SINEREOS

#1 ARE WE RE-TESTING AFTER A BREAK-OUT ?

OR

#2 ARE WE SITTING ON A MULTIPLE SUPPORT AREA ?

Always ,,, Remeber ........

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

I am looking to buy low and sell high and this is one of two diffrent ways that I can think of to determin if a market is low or high... espesially on the Longer Term charts..... This appraoch is also way better than looking for 123 bottoms , if you are familiar with this methodolgy ...

One most also , use sound money management when attempting to trade with this method or any other type of method ..... RISK TO REWARD SHOULD ALWAYS BE CONSIDERED

THIS IS VERY, VERY IMPORTANT ....... WITH IMPORTANCE

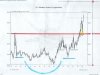

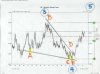

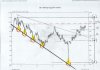

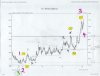

HERE ARE VARIOUS EXAMPLES .......

THEY ARE ALL FROM DIFFRENT TIME FRAMES

LONG AND SHORT AND INTRA DAY .....

ALL ILLUSTRATING THE SAME PRINCIPAL

ANOTHER POST WILL BE ADDED LATER .... WITH EXAMPLES OF MULTIPLE SUPPORT AREAS....

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliot Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …

My Trading Style ?

#1 Find multiple support areas on ..... Weekly and Monthly charts ....

( They will be more reliable, than on Daily or Intraday charts because of

what's called Market Noise... that occurs Intraday ... )

# 2 Buy , when a market is sitting on what appears to be multiple support and coordinate this with Fibbonacci Retracement levels...

(If .. you don't know what a Fibonacci Retracement level is THEN

Resaerch this topic on your own,,, )

# 3 ,, STAY AWAY FROM BREAK - OUTS ,

ITS TOO LATE !

To sum this all up ,,,, What I look for Visually, in all of this , is for a break- out through a resistance line and the a pullback..

(BULLISH SENERIO )

When I say pullback ,,, it also means TEST ,.......

Or in other words , the retest of an old resistance line ....

Because ,that's what it appears to be doing... which is retesting the old Resistance line area ..

BREAK-OUT THEN THE PULLBACK ... (TEST AREA )

This theory is no diffrent than traders who make momentum plays off of lets say a 20 day or 50 day moving averegaes ....Just look at Google is in a strong uptrend .... any dip below a 20 0r 50 day average ,, because its in a strong uptrend,,,,, it presents itself as support to the seasoned trader ... they are basically looking for a pull back in price off of recent strength in a given market .

SO WHAT I AM LOOKING FOR IS ONE OF THESE 2 SINEREOS

#1 ARE WE RE-TESTING AFTER A BREAK-OUT ?

OR

#2 ARE WE SITTING ON A MULTIPLE SUPPORT AREA ?

Always ,,, Remeber ........

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

BREAK-OUT ,,,,, THEN TEST

I am looking to buy low and sell high and this is one of two diffrent ways that I can think of to determin if a market is low or high... espesially on the Longer Term charts..... This appraoch is also way better than looking for 123 bottoms , if you are familiar with this methodolgy ...

One most also , use sound money management when attempting to trade with this method or any other type of method ..... RISK TO REWARD SHOULD ALWAYS BE CONSIDERED

THIS IS VERY, VERY IMPORTANT ....... WITH IMPORTANCE

HERE ARE VARIOUS EXAMPLES .......

THEY ARE ALL FROM DIFFRENT TIME FRAMES

LONG AND SHORT AND INTRA DAY .....

ALL ILLUSTRATING THE SAME PRINCIPAL

ANOTHER POST WILL BE ADDED LATER .... WITH EXAMPLES OF MULTIPLE SUPPORT AREAS....

TRADE AT YOUR OWN RISK… The purpose of these charts is to point out significant highs and lows based on Fibonacci Retracement lines and Elliot Waves which are highly subjective . This information is for educational purposes and should not be considered trading recommendations . All trading decisions are your own sole responsibility …