- Joined

- 23 September 2007

- Posts

- 454

- Reactions

- 1

Finally getting starting into Forex and it has opened up a whole new world to me... I can see potentials and with the ability to trade multiple pairs in real time with huge leverage, it's a receipe to fast track wealth or put me on the streets

Anyway,.. been trading S/R with some success. Winning 7 in 10 trades with 2:1 RR, so it's smooth sailing so far...

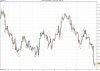

However, I keep on going back to trying to scalp it for a few pips here and there. I have noticed that on many pairs - mainly concentrating on the A/U for now - that when it crosses a psyschological level like 0.8700, 0.8650, 0.8600, etc... it tends to over shoot it by atleast 1 or 2 pips...

I've backchecked this roughly (manually) for a few months and it looks like it's good. With SL at 20pips seems to be safe... (I know what you are thinking 1:20 RR is CRAZY!!!! )

)

So, my question... what's stoping me from doing a, say $1000 contract for 1 pip at these levels? Is there enough liquidity to carry this order through?

Does anyone else do this? I'm sure I'm not the first to notice this behaviour.

So far this morning, I've managed to steal 3 trades of 2 pips each as it crossed 0.8600 on the A/U pair... through IG Markets on $20 contracts...

If I want to do this with larger contracts, should I be using an ECN or MM broker?

Anyway,.. been trading S/R with some success. Winning 7 in 10 trades with 2:1 RR, so it's smooth sailing so far...

However, I keep on going back to trying to scalp it for a few pips here and there. I have noticed that on many pairs - mainly concentrating on the A/U for now - that when it crosses a psyschological level like 0.8700, 0.8650, 0.8600, etc... it tends to over shoot it by atleast 1 or 2 pips...

I've backchecked this roughly (manually) for a few months and it looks like it's good. With SL at 20pips seems to be safe... (I know what you are thinking 1:20 RR is CRAZY!!!!

So, my question... what's stoping me from doing a, say $1000 contract for 1 pip at these levels? Is there enough liquidity to carry this order through?

Does anyone else do this? I'm sure I'm not the first to notice this behaviour.

So far this morning, I've managed to steal 3 trades of 2 pips each as it crossed 0.8600 on the A/U pair... through IG Markets on $20 contracts...

If I want to do this with larger contracts, should I be using an ECN or MM broker?