- Joined

- 19 November 2007

- Posts

- 551

- Reactions

- 0

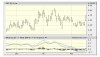

CXC up 10% today. This could be the start of a serious upmove after 2 years of down for Coeur and 1.5 years of sideways for Bolnisi.

CXC are Chess Depositary Interests (basically the same as shares) of Coeur (CDE on Nasdaq) which after merging with Bolnisi Gold on Dec 12th is poised to become the world's biggest primary silver miner. Within a year it should be mining 30m oz of Ag. CXC has been admitted into the ASX 200 as BSG was before the merger.

CXC are Chess Depositary Interests (basically the same as shares) of Coeur (CDE on Nasdaq) which after merging with Bolnisi Gold on Dec 12th is poised to become the world's biggest primary silver miner. Within a year it should be mining 30m oz of Ag. CXC has been admitted into the ASX 200 as BSG was before the merger.