You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading styles of Livermore/Wyckoff

- Thread starter stargazer

- Start date

Hi all

Could someone explain the different trading styles between

Livermore and Wyckoff

Cheers

SG

hello stargazer,

From My understanding of the Historical literature..

Wyckoff and Livermore met each other in 1917.

Livermore as the biggest operator of His day influenced Wyckoff.. Both as to what to do and not what to do.

Wyckoff over time developed a purely technical system

With a strong focus on Risk.

(The Wyckoff/SMI course)

He built a rigorous system built from first principles.

Livermore Was much more orientated by Fundamentals, Stuck to His hunches

and Did not in practice have a systematic approach to risk.. He would often

buck the trend... He would plunge ..

Livermore made and lost fortunes.. And blew up big..

Wyckoff Just made fortunes..

Wyckoff overtime went from a more fundamental approach (1900)

To a purely technical approach (1930) He realized that prices moved way to much than real fundamentals should allow and that the real fundamentals were only know by the very few and unfolded over time (trends).

And that all markets are manipulated (By everybody, large and small)

motorway

Richard D. Wyckoff was born in 1873, and at the age of 15 in 1888, became a stock runner.

At the age of 25, He opened his own brokerage which gave him close contact with a number of the most important and influential traders on Wall Street . He studied the market operations and investing methods of Jay Gould,James Keene, Edward Wasserman, Jesse Livermore, J.P. Morgan, Andrew Carnegie, and others, as He set about attempting to develop his own approach to the market.

Wyckoff’s skills grew as he developed an understanding of what makes a market, or a stock, move. He was able to see the market from the views and actions of all it's participants. Big and small, losers and winners..Insiders and outsiders..

His method is based on three laws that govern market behavior: The law of Supply and Demand, The law of Cause and Effect and The Law of Effort VS Result.

Wyckoff's Method revolves around "The Three laws" "The Five Steps" "The nine tests" "The rules of three" "The four phases" "The four qualties (spread/range, close , volume & position )"

"The eight buy or sell setups"

The Five Steps

Step 1:

Determine the trend and the position within that trend of the general market.

Step 2:

Select those stocks that are in harmony with the market

Step 3:

Select those stocks that have built a potential for a move

Step 4:

Determine each stock’s readiness to move

Step 5:

Time commitments with the turns in the general market

Richard Wyckoff became a celebrity name on Wall Street during the early decades of the twentieth century, an epoch many observers believe was truly a golden age for tape readers, chartists, and speculators. Wyckoff earned a fortune from his Magazine of Wall Street, along with other publications and advisory services. The accuracy and power of his analysis and predictions gained him a titan-like status in the eyes of his 200,000 subscribers--an incredibly large following even by today's standards.

(He in fact kept increasing the price of His "trend letter" to reduce the number of subscribers.... it did not work)

The Wyckoff method has stood the test of time. Over 100 years of

continuous development and usage have proven the value of the Wyckoff

method for use with stocks, bonds, currencies, and commodities around

the globe. This accomplishment should come as no surprise because, as

explained in the previous section, The Wyckoff method reveals the

"real rules of the game."

"The passing of all nine Wyckoff tests determines the speculative line

of least resistance to the upside or downside."

Hank Pruden, The Three Skills of Top Traders

"Study your charts not with an eye to comparing the shapes of the formations. Rather study your charts or tape from the viewpoint of the behavior of the stock, the motives of those who are dominate in it, and the successes and failures of the buyers and sellers as they struggle for mastery on every move." " Not what Others are saying about markets, but what markets are saying about Others "

Richard D. Wyckoff

Wyckoff Method does this by looking at the How not just the what.

The How of The What on all time frames.

regards

motorway

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,470

- Reactions

- 9,770

Hi all

Could someone explain the different trading styles between

Livermore and Wyckoff

Cheers

SG

A good book on Wyckoff is "Charting the stock market The Wyckoff Method " by Jack Hutson.

I got it years ago with difficulty from a Melbourne supplier called Success Tools.

I did a quick search in ASF Store and couldn't find it.

Perhaps Joe could source it for you.

Its not an easy read but instructive. Its very prescriptive and not an easy method to follow in real life.

I now mainly use it if I have difficulty sleeping, reading it along with Phillip Adams LNL 's tiresome lefty drone, on snooze, puts me out in under fifteen minutes.

Garpal

The Hutson Book

was a series of articles in Technical analysis of stocks and commodities.

It does have deficiencies.. It has three Authors... The middle section is a bar by bar analysis by David Weis..

It does contain a form of the nine tests for example

But other aspects only lucky to get a mention..

Not much on effort/ result

For some background on David Weis

look here http://www.amazon.com/Entries-Exits-Visits-Trading-Rooms/dp/0471678058

Search inside the book with " David Weis " Some info on His Elliot Wave back ground and why He became a Wyckoff Practitioner..

All books can but be very sketchy compared to the Wyckoff Course material.

There are some articles around the web... And there are some options in obtaining good material..

PM Me if You are interested.

Hank Pruden has a new book out

He is a professor who teaches Wyckoff at Golden Gate University..

Getting Good reviews

"At long last, someone has taken the time and effort to bring the work and insight of Wyckoff to wider public attention -- and Hank Pruden has done so masterfully, with great clarity and eloquence. Hank has taken the best of Wyckoff's work, combining it with the essential aspects of trader discipline and psychology, to provide a highly readable and particularly useful guide to trading. MUST READING!"

Jacob Bernstein

The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State Management HANK PRUDEN

PART ONE Systems Building and Behavioral Finance.

CHAPTER 1 Systems Building for the Three Skills of Top Trading.

CHAPTER 2 Behavioral Finance.

CHAPTER 3 The Life Cycle Model of Crowd Behavior.

PART TWO Pattern Recognition and Discretionary Trading.

CHAPTER 4 Wyckoff: The Man, the Method, the Mystique.

CHAPTER 5 The Basic Elements of Charting for the Wyckoff Method.

CHAPTER 6 The Wyckoff Method of Technical Analysis and Speculation.

CHAPTER 7 Anatomy of a Trade.

PART THREE Mental State Management.

CHAPTER 8 Trader Psychology and Mental Discipline.

CHAPTER 9 The Composite Man.

CHAPTER 10 Putting It All Together: Ten Principles for a Trader to Live.

SMI course contains 5 units of study

takes 9mths to work through

So all books can only be in a sense introductions and/or very condensed.

motorway

was a series of articles in Technical analysis of stocks and commodities.

It does have deficiencies.. It has three Authors... The middle section is a bar by bar analysis by David Weis..

It does contain a form of the nine tests for example

But other aspects only lucky to get a mention..

Not much on effort/ result

For some background on David Weis

look here http://www.amazon.com/Entries-Exits-Visits-Trading-Rooms/dp/0471678058

Search inside the book with " David Weis " Some info on His Elliot Wave back ground and why He became a Wyckoff Practitioner..

All books can but be very sketchy compared to the Wyckoff Course material.

There are some articles around the web... And there are some options in obtaining good material..

PM Me if You are interested.

Hank Pruden has a new book out

He is a professor who teaches Wyckoff at Golden Gate University..

Getting Good reviews

"At long last, someone has taken the time and effort to bring the work and insight of Wyckoff to wider public attention -- and Hank Pruden has done so masterfully, with great clarity and eloquence. Hank has taken the best of Wyckoff's work, combining it with the essential aspects of trader discipline and psychology, to provide a highly readable and particularly useful guide to trading. MUST READING!"

Jacob Bernstein

The Three Skills of Top Trading: Behavioral Systems Building, Pattern Recognition, and Mental State Management HANK PRUDEN

PART ONE Systems Building and Behavioral Finance.

CHAPTER 1 Systems Building for the Three Skills of Top Trading.

CHAPTER 2 Behavioral Finance.

CHAPTER 3 The Life Cycle Model of Crowd Behavior.

PART TWO Pattern Recognition and Discretionary Trading.

CHAPTER 4 Wyckoff: The Man, the Method, the Mystique.

CHAPTER 5 The Basic Elements of Charting for the Wyckoff Method.

CHAPTER 6 The Wyckoff Method of Technical Analysis and Speculation.

CHAPTER 7 Anatomy of a Trade.

PART THREE Mental State Management.

CHAPTER 8 Trader Psychology and Mental Discipline.

CHAPTER 9 The Composite Man.

CHAPTER 10 Putting It All Together: Ten Principles for a Trader to Live.

SMI course contains 5 units of study

takes 9mths to work through

So all books can only be in a sense introductions and/or very condensed.

motorway

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

Hi all

Could someone explain the different trading styles between

Livermore and Wyckoff

Cheers

SG

Hi,

I don't know to much about Wyckoff.

But I know a little about Livermore, He did not use charts that much at all.

Thought they where confusing with all there averages! - From How to trade in stocks - Livermore)

He used a system which is known as the Livermore market key. He had a mathematical formula for working out what he called pivotal points not sure if any one apart from him knows what formula he used.

From what i have read he would read / see the prices coming in off the tape and divide them and work out patterns in the numbers, strengh or weakness.

He kept running price records on a book from his records he could work out the pivotal price for a long or short. He was a excellent tape reader.

He also believed in stacking winers so he would test the market and add to it as it went in his favor.

Also from his works that i have read he was a very strong range follower and break out trader. One of the best things I read him say is: There are only a few profitable times in a year to make money from a market.(from How to trade in stocks, Livermore) So I can guess he would wait and then buy and hold for some time, consistently adding to his winner.

But one very weak point of Livermore he had little self control and did not follow his rules with devastating effects!

I value him much more over a lot of other great trades cuz he could come back even when he was in over 1 million dollars debt at one stage.

I my opinion he was a true market genius in the top 3 of all time.

Another funny point, I think Gann also lent him cash when he went broke once as well.

Wyckoff thought highly of Livermore..

Pruden in the 1970s read and was captivated by reminiscences of a stock operator... He wished someone had built a systematic method from the insights with in it..

When He found Wyckoff he found that someone had and more.

In 1908 Wyckoff wrote the first complete technical approach to mkts

coining words that became common usage ( eg point of resistance )

livermore Did not use charts

His market Key is a type of Point and Figure chart in tabular form

( like a 6 box reversal chart )

But that book is much after the fact

And was an attempt to attract money into a type of managed fund he hoped to earn fees from running ( he was broke I think for the eight time )

Much more to Livermore than that book..

IF you bet that big with that much risk

You either become famous or you disappear without a trace

double or nothing..

motorway

Livermore has made and can make more millions out of small bank accounts than any operator since Jim Keene.

Keene rarely ventured the bulk of His fortune in a single play, but Livermore does not hesitate to do so. Supreme confidence in His own judgement, and His ability to come back lead Him to take risks that would appall most operators.

Pruden in the 1970s read and was captivated by reminiscences of a stock operator... He wished someone had built a systematic method from the insights with in it..

When He found Wyckoff he found that someone had and more.

In 1908 Wyckoff wrote the first complete technical approach to mkts

coining words that became common usage ( eg point of resistance )

livermore Did not use charts

His market Key is a type of Point and Figure chart in tabular form

( like a 6 box reversal chart )

But that book is much after the fact

And was an attempt to attract money into a type of managed fund he hoped to earn fees from running ( he was broke I think for the eight time )

Much more to Livermore than that book..

IF you bet that big with that much risk

You either become famous or you disappear without a trace

double or nothing..

motorway

A good book on Wyckoff is "Charting the stock market The Wyckoff Method " by Jack Hutson.

I got it years ago with difficulty from a Melbourne supplier called Success Tools.

I did a quick search in ASF Store and couldn't find it.

Perhaps Joe could source it for you.

Its not an easy read but instructive. Its very prescriptive and not an easy method to follow in real life.

I now mainly use it if I have difficulty sleeping, reading it along with Phillip Adams LNL 's tiresome lefty drone, on snooze, puts me out in under fifteen minutes.

Garpal

you can get the book from Amazon (united states) delivered for approx 33$AUS

>Apocalypto<

20.03.2012

- Joined

- 2 February 2007

- Posts

- 2,233

- Reactions

- 2

But that book is much after the fact

And was an attempt to attract money into a type of managed fund he hoped to earn fees from running ( he was broke I think for the eight time )

Motorway,

What book are you talking about? the Smitten version? Where did you get that info from?

I read the 1940 original by Livermore. How to trade in stocks.

(his son Jesse Jnr told him to think about righting a book about how he thought people should trade stocks.)

It is amazing how many of his teachings are common place trading now!

Also read Reminiscences of a Stock Operator.

He shot himself after fourth time he was declared bankrupt, just after his book was published. From what I have read he was in deep depression at this point.

I have seen those statements made in various places

One source is.

Jesse Livermore Speculator King By paul Sanoff

Here is the true story of a man once blamed for causing the 1929 crash, a man blamed for every market break from 1917 to 1940. Here are his trials and triumphs, told with empathy and forthrightness. Here is one of the most legendary figures ever to haunt the annals of the stock market-Livermore brought startlingly to life.

1967 (paper). 136pp

( This book paints a very different picture from the smitten material )

There were two versions of the 1940 book

I have read the one with the Family crest on it..

When Smitten published His books the originals seem to no longer be available

motorway

One source is.

Jesse Livermore Speculator King By paul Sanoff

Here is the true story of a man once blamed for causing the 1929 crash, a man blamed for every market break from 1917 to 1940. Here are his trials and triumphs, told with empathy and forthrightness. Here is one of the most legendary figures ever to haunt the annals of the stock market-Livermore brought startlingly to life.

1967 (paper). 136pp

( This book paints a very different picture from the smitten material )

There were two versions of the 1940 book

I have read the one with the Family crest on it..

When Smitten published His books the originals seem to no longer be available

motorway

My principle method is to study the effect of present and probable future conditions on the earning power of the various companies.........Anticipation of coming events is the whole thing....... to study the effects of future business conditions say six months or a year out

Jesse Livermore

No Man can succeed.......unless He acquires a fundamental knowledge of economics .. with conditions of every sort. The financial position of a company, it's past history, production, as well as the state of the industry in which it is engaged , and the general economic situation

Jesse Livermore

Some quotes from Jesse Livermore

around the time of Reminisces..

Come as a surprise to some maybe

He was a formidable Tape reader..

Some chapters in Reminisces are Very Good

Ch XV11

For example... That is very Wyckoff a number of good themes in that chapter

motorway

Hi,

I don't know to much about Wyckoff.

But I know a little about Livermore, He did not use charts that much at all.

Thought they where confusing with all there averages! - From How to trade in stocks - Livermore)

He used a system which is known as the Livermore market key. He had a mathematical formula for working out what he called pivotal points not sure if any one apart from him knows what formula he used.

From what i have read he would read / see the prices coming in off the tape and divide them and work out patterns in the numbers, strengh or weakness.

He kept running price records on a book from his records he could work out the pivotal price for a long or short. He was a excellent tape reader.

He also believed in stacking winers so he would test the market and add to it as it went in his favor.

Also from his works that i have read he was a very strong range follower and break out trader. One of the best things I read him say is: There are only a few profitable times in a year to make money from a market.(from How to trade in stocks, Livermore) So I can guess he would wait and then buy and hold for some time, consistently adding to his winner.

But one very weak point of Livermore he had little self control and did not follow his rules with devastating effects!

I value him much more over a lot of other great trades cuz he could come back even when he was in over 1 million dollars debt at one stage.

I my opinion he was a true market genius in the top 3 of all time.

Another funny point, I think Gann also lent him cash when he went broke once as well.

Successful tape reading is a study of force; it requires ability to judge which side has the greatest pulling power and one must have the courage to go with that side. There are critical points which occur in each swing, just as in the life of a business or of an individual. At these junctures it seems as though a feather's weight on either side would determine the immediate critical trend. Any one who can spot these points has much to win and little to lose, for he can always play with a stop placed close behind the turning point or "point of resistance". . This study of ‘responses’ to stimulation or outside influences on stocks is one of the most valuable in the Tape Reader's education. It is an almost unerring guide to the technical position of the market. Of course, all responses are not so clearly defined.

It is a matter of indifference to the Tape Reader as to who or what produces these tests, or critical periods. They constantly appear and disappear; he must make his diagnosis and act accordingly. If a stock is being manipulated higher, the movement will seldom be continued unless other stocks follow and support the advance. Barring certain specific developments affecting a stock, the other issues should be watched to see whether large operators are unloading on the strong spots. Should a stock fail to break on bad news, it means that insiders have anticipated the decline and stand ready to buy.

Sounds like something out of Livermores 1940 book

IT is is out of Wyckoff's first published in 1908

What is Tape Reading?

This question may be best answered by first deciding what it is not.

Tape Reading is not merely looking at the tape to determine how prices are running.

It is not reading the news and then buying or selling "if the stock acts right."

It is not trading on tips, opinions, or information.

It is not buying "because they look strong," or selling "because they look weak."

It is not trading on chart indications or by other mechanical methods.

It is not "buying on dips and selling on peaks."

Nor is it any of the hundred other foolish things practiced by the millions of people without method, planning or strategy.

It seems to us, based on our experience, that Tape Reading is the defined science of determining from the tape the immediate trend of prices. It is a method of forecasting, from what appears on the tape now in the moment, what is likely to appear in the immediate future. Its object is to determine whether stocks are being accumulated or distributed, marked up or down, or whether they are being neglected by the large investors.

The Tape Reader aims to make deductions from each succeeding transaction - every shift of the market kaleidoscope, to grasp a new situation, force it, lightning-like, through the weighing machine of the mind, and to reach a decision which can be acted upon with coolness and precision. It is gauging the momentary supply and demand in particular stocks and in the whole market, comparing the forces behind each and their relationship, each to the other and to all.

A trader is like the manager of a department store; into his office are submitted hundreds of reports of sales made by the various departments. He notes the general trend of business - whether demand is heavy or light throughout the store, but lends special attention to the products in which demand is abnormally strong or weak.

When he finds it difficult to keep his shelves full in a certain department or of a certain product, he instructs his buyers accordingly, and they increase their buying orders for that product; when certain products do not move he knows there is little demand (or a market) for them, therefore, he lowers his prices (seeking a market) to induce more purchases by his customers.

The Tape Reader, from his perch at the ticker, enjoys a bird's eye view of the whole field. When serious weakness develops in any quarter, he is quick to note the changes taking place, weigh them and act accordingly.

Another advantage in favour of the Tape Reader: The tape tells the news minutes, hours and days before the newspapers, and before it can become current gossip. Everything from a foreign war to the elimination of a dividend; from a Supreme Court decision to the ravages of the boll-weevil is reflected primarily upon the tape.

The insider who knows a dividend is to be jumped from 6 per cent to 10 per cent shows his hand on the tape when he starts to accumulate the stock, and the investor with 100 shares to sell makes his fractional impress upon its market price.

The market is like a slowly revolving wheel. Whether the wheel will continue to revolve in the same direction, stand still or reverse depends entirely upon the forces which come in contact with its hub and tread. Even when the contact is broken, and nothing remains to affect its course, the wheel retains a certain impulse from the most recent dominating force, and revolves until it comes to a standstill or is subjected to other influences.

Richard D Wyckoff

from Studies in Tape Reading 1908 & 1910

markets make opinions .. That is why there is oversold and overbought

peril and opportunity..

Wyckoff advises Us to be in harmony with the trend , But to identify the forces of accumulation and distribution and the pivotal points where the other side starts to enter..

These are the Buying and selling climaxes

From these seeds in 1908 flowered the Wyckoff/ SMI course and much that is known today as Technical Analysis..

motorway

RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

Sounds like something out of Livermores 1940 book

IT is is out of Wyckoff's first published in 1908

markets make opinions .. That is why there is oversold and overbought

peril and opportunity..

Wyckoff advises Us to be in harmony with the trend , But to identify the forces of accumulation and distribution and the pivotal points where the other side starts to enter..

These are the Buying and selling climaxes

From these seeds in 1908 flowered the Wyckoff/ SMI course and much that is known today as Technical Analysis..

motorway

Motorway, I've just come across some of your posts on ASF.

Being a recent student of the markets I have to say that I'm very glad to have you for company. Your posts are concise and very educational. Thank you for sharing your knowledge and experience.

I have an interest is Wyckoff's work as well but I'm a long way from your level of understanding.

I was looking for some pointers on the best work on or by Wyckoff for study, you seem to have give some great pointers in this thread and elsewhere, time to hit the bookshops! If there are any online resources you recommend maybe you can post them in a new Wyckoff thread or in this thread. I would be interested to hear about how you came to practice Wyckoff's methods.

RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

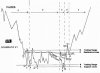

Here's a link to a description of a 'Wyckoff Spring' (the image and commentary shown in the link is included in this post), I'm no expert so I hope this is correct, it looks ok: http://bigpicture.typepad.com/comments/2004/05/wyckoff_spring.html

Using this chart as a guide, here's a simplified overview of Wyckoff's methodology:

Wyckoff's World Chart: Source: San Francisco Technical Securities Analysts Association.......

....

Phase A is characterized by a prolonged decline to "preliminary support" (PS on the chart), which provides temporary relief before the "selling climax" (SC). That climax is accompanied by sharply expanding volume as weak holders bail out in a panic. The climax is followed by an "automatic rally" (AR), suggesting the selling has been exhausted, and then a "secondary test" (ST) of the climax lows, during which volume is diminished. Phase B contains basing action characterized by a series of rallies and secondary tests. The "creek" on the chart basically refers to a trendline connecting peaks of said rallies. A "jump across the creek" is a "sign of strength" (SOS) that provides evidence a bottom has occurred and buyers are emerging. These "jumps" occur in phases C and D on the chart.

Also in phase C, there's another selloff and a marginal break of the selling climax lows. If such a test is accompanied by lower volume than that during the selling climax, it could be a setup for a Wyckoff Spring, a bullish pattern detailed here in March 2001.

Following the spring (no. 8 on the chart) and those "signs of strength" in phases C and D, there's another selloff in phase D to the "last point of support" (LPS), after which this hypothetical example explodes higher.

Attachments

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,470

- Reactions

- 9,770

Here's a link to a description of a 'Wyckoff Spring' (the image and commentary shown in the link is included in this post), I'm no expert so I hope this is correct, it looks ok: http://bigpicture.typepad.com/comments/2004/05/wyckoff_spring.html

Thanks for the Wyckoff info.

A stock I bought recently fulfils some of Wyckoff's ideas.

Here is the chart

KIL

Garpal

Attachments

- Joined

- 21 April 2005

- Posts

- 3,922

- Reactions

- 5

From my studies of wyckoff one will only get a partial education in it if one does not do the EXPENSIVE course. Anything less would be doing injustice to the way. Material is hard to get in a complete manner.

The course anwers all the questions one has when studying the partial material. Missing the nuances will see FAILURE.

The course anwers all the questions one has when studying the partial material. Missing the nuances will see FAILURE.

Well If anyone is interested in discussing stocks from a wyckoff Viewpoint

I think it would be worthwhile.. It has been said that 90% of TA is derived from Wyckoff.. The full course is available Something that has been going for

That long on zero hype.. Has certainly stood the test of time.

The best is not always of today.. The best has often been defined and had it's golden age in the past... The full course itself still is a living thing

It is a course as in a real course ,5 units of study with exams and I think life time support.. Said to take 9 mths of steady application.. cost I believe USD $850...

However It is OK to start somewhere. There is reasonable amount of material to look at and work with outside of obtaining the course..Which maybe end up leading one to acquire the course in any case.

motorway

And way back in 1908

Any one who can spot these points has much to win and little to lose, for he can always play with a stop placed close behind the turning point or "point of resistance"

I think it would be worthwhile.. It has been said that 90% of TA is derived from Wyckoff.. The full course is available Something that has been going for

That long on zero hype.. Has certainly stood the test of time.

The best is not always of today.. The best has often been defined and had it's golden age in the past... The full course itself still is a living thing

It is a course as in a real course ,5 units of study with exams and I think life time support.. Said to take 9 mths of steady application.. cost I believe USD $850...

However It is OK to start somewhere. There is reasonable amount of material to look at and work with outside of obtaining the course..Which maybe end up leading one to acquire the course in any case.

motorway

This is a method of judging the stock market by its own action.

It is intended for investors as well as for traders.

It has been planned and prepared for those who desire to safeguard

their investment capital against, and to make money from, the

fluctuations in the prices of stocks dealt in on the New York Stock

Exchange or any other organized exchange.

It is applicable as well to bonds, preferred stocks and the leading

commodity markets.

Anyone who buys or sells a stock, a bond, or a commodity for profit

is speculating if he employs intelligent foresight.

If he does not, he is gambling.

Your purpose should be to become an intelligent, scientific and

successful investor and trader.

This Method is for those who have had either little or no experience

operating in the stock market, or for those who have had much

experience but who have never been shown the real rules of the game.

Out of the very limited number who really understand the inner

workings of the stock market, practically no one has been willing to

show the public the real inside. I believe it is time for someone to

step forward and do this and so I am here offering the cream of what I have learned in forty years of active experience in Wall Street.

By the methods herein explained, I have made a great deal of money for myself and my clients and subscribers who numbered in excess of 200,000. By

making this available to those who desire to learn the business of trading and investing in stocks -- for it is a business just like law, medicine or any

other -- I hope to be of still greater service, not only to my former patrons, but to others who have not had an opportunity to invest under favorable conditions.

You can learn from this how to develop independent judgment, so that you need never ask anyone’s opinion or listen to anyone’s tips, or take anybody’s advice. You can so train your judgment that you will know just what to do and when to do it. When you are in doubt you will do nothing.

I do not claim that you can be invariably right. No one could. What I aim to do is to show you how to be right in the majority of instances. This will require close study and self-training on your part.

I will teach you how to read the market from your daily newspaper; from the tape of the stock ticker; from your charts, or any or all combined.

I will teach you to plan your stock market campaigns just as a general plans his battles.

I, therefore, claim that:

You need never read anything on the financial page of your newspaper except the table of stock prices and volumes.

You need pay no attention to the news, earnings, dividend rates or statements of corporations.

You need never study the financial or the business situation.

You need not understand railroad or industrial statistics, the money market, the crop situation, the bank statements, foreign trade or the political situation.

You can absolutely ignore all the thousands of tips, rumors, reports and especially the so-called inside information that flood Wall Street.

You can discard all of these completely, and finally.

UNLESS YOU DO THIS YOU WILL BE UNABLE TO GET THE BEST RESULTS FROM YOUR MARKET OPERATIONS.

Whenever you study the tape or a chart, consider what you see there

as an expression of the forces that lift and depress prices. Study

your charts not with an eye to comparing the shapes of the

formations, but from the viewpoint of the behavior of the stock; the

motives of those who are dominant in it; and the successes and

failures of the buyers and sellers as they struggle for mastery on

every move.

Every upward or downward swing in the market, whether it amounts to

many points, only a few points, or fractions of a point, consists of

numerous buying and selling waves. These have a certain duration;

they run just so long as they can attract a following. When this

following is exhausted for the time being, that wave comes to an end

and a contrary wave sets in. The latter may attract more of a

following than the former. By studying the relationships between

these upward and downward waves, their duration, speed and extent,

and comparing them with each other, we are able to judge the

relative strength of the bulls and the bears as the price movement

progresses.

When you are looking for an opportunity to buy, watch for the DOWN

waves in the market and in your stock. After you have bought, you

sit through a number of small, medium and good-sized waves, until

finally you observe that it is about flood tide in that stock. Then

watch for an especially strong up-wave and give your broker an order

to sell your stock at the market.

The waves of the market furnish a clear insight into changes in

supply and demand. By learning to judge all sizes of market waves,

you will gradually learn to spot the time when a rising market or a

rally, and the time when a declining market or a reaction, has

halted and is about to reverse. THESE ARE THE TURNING POINTS.

Richard D. Wyckoff

And way back in 1908

Any one who can spot these points has much to win and little to lose, for he can always play with a stop placed close behind the turning point or "point of resistance"

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,417

- Reactions

- 6,356

Motorway.

Thanks again.

Interesting that Wyckoff speaks also of waves.

The combination and proficiency in BOTH Wyckoff methods and Elliot would seem advantageous.

The course I am taking.

There is some great software now days which can help the practitioner.

However a good understanding is definately required in bothe fields for best application.

Well thats my view.

Mind you both can stand alone as trading methods.

Joint application makes sence to me.

Thanks again.

Interesting that Wyckoff speaks also of waves.

The combination and proficiency in BOTH Wyckoff methods and Elliot would seem advantageous.

The course I am taking.

There is some great software now days which can help the practitioner.

However a good understanding is definately required in bothe fields for best application.

Well thats my view.

Mind you both can stand alone as trading methods.

Joint application makes sence to me.

Bronte

Trading The SPI for 20+ years

- Joined

- 30 July 2005

- Posts

- 1,525

- Reactions

- 1

And way back in 1908

Any one who can spot these points has much to win and little to lose, for he can always play with a stop placed close behind the turning point or "point of resistance"

Richard Wyckoff made the distinction between mechanical identification of patterns and the objective identification of supply and demand that might or might not make or produce a certain pattern.

The Father of the former is Richard Schabacker. He studied charts looking for patterns that would tend to lead to the

same result. eg Head and shoulders etc. We look out for examples of idealized models. We look at the artifacts left behind as the price activity unfolds.

Richard Wyckoff begins with a set of principles which He identifies at work and then responds to them with appropriate action in real time.

A principle is more than a pattern. It is a statement that is always true.

Wyckoff articulated three primary principles or laws:

1) The Law of Supply and Demand:

Markets go up when demand exceeds supply. They go down when supply exceeds demand. They form a trading range when the two are in a certainequilibrium.

(So this is always a starting point what are prices actually DOING)

Hence there are three types of active trends not just two.

Also a fourth state of nothingness.

2) The Law of Cause and Effect

The effect realised by a cause will be in direct proportion to that cause. To get an important move

(the effect), there must be a significant cause.

The cause as a potential is generated in an active trading range.

3) The Law of Effort and Result

What is important is not only price but also the character of the volume that is producing price. When volume and price are in harmony, there will be a continuity. When they diverge there will be a change.

These laws operate on all time frames. There is an interaction between time frames..

Wyckoff from these three laws developed a set of further principles for identifying how a market moves, how it terminates its trends and the appropriate trading strategies for the various phases and stages of market activity.

An extremely important observation Wyckoff makes is that markets move in waves. The magnitude of these waves their action in time and price determines the nature and character of the underlying trends.

(character, behaviour, change of behaviour, movement, ease of movement)

It is critical to always determine the trend of the timeframe we are

trading and it's context within the trends of the other time frames.

And in the context of the trends of the market, sectors and other stocks..

This must be determined in an objective manner...

directly From the price and volume activity .

Step 1:

Determine the trend and the position within that trend.

This step involves the use of certain trendlines

Both by their Use and by their reverse use.

Some of the things measured are the angle at which the trend is moving, the amount of progress being made on each drive up and drive down called the thrust and the measurement of the comparative strength, weakness and the adequacy of each correction.

Also position as defined by the Wyckoff concepts of overbought and oversold. (and He is Not talking about ANY oscillator like a RSI etc..)

At the heart of Wyckoff's method is the concept of Action and Test. Action and Response. If we see an Action We look to the response for the secondary test. A failed test a poor response Then a trade is doubtful. We look and wait for successful tests for positve responses..

We look for the line of least resistance to define itself and become obvious..

Such that after our entry

Wyckoff stated in the quote above that When We Judge that We should be making a long position We are looking esp at the down waves of activity

By recognising That markets move in waves a Greater amount of insight is possible. We proceed from principles that are always correct in their application.. When We are clear We act, When We are not clear We wait ..

motorway

The Father of the former is Richard Schabacker. He studied charts looking for patterns that would tend to lead to the

same result. eg Head and shoulders etc. We look out for examples of idealized models. We look at the artifacts left behind as the price activity unfolds.

Richard Wyckoff begins with a set of principles which He identifies at work and then responds to them with appropriate action in real time.

A principle is more than a pattern. It is a statement that is always true.

Wyckoff articulated three primary principles or laws:

1) The Law of Supply and Demand:

Markets go up when demand exceeds supply. They go down when supply exceeds demand. They form a trading range when the two are in a certainequilibrium.

(So this is always a starting point what are prices actually DOING)

Hence there are three types of active trends not just two.

Also a fourth state of nothingness.

2) The Law of Cause and Effect

The effect realised by a cause will be in direct proportion to that cause. To get an important move

(the effect), there must be a significant cause.

The cause as a potential is generated in an active trading range.

3) The Law of Effort and Result

What is important is not only price but also the character of the volume that is producing price. When volume and price are in harmony, there will be a continuity. When they diverge there will be a change.

These laws operate on all time frames. There is an interaction between time frames..

Wyckoff from these three laws developed a set of further principles for identifying how a market moves, how it terminates its trends and the appropriate trading strategies for the various phases and stages of market activity.

An extremely important observation Wyckoff makes is that markets move in waves. The magnitude of these waves their action in time and price determines the nature and character of the underlying trends.

(character, behaviour, change of behaviour, movement, ease of movement)

It is critical to always determine the trend of the timeframe we are

trading and it's context within the trends of the other time frames.

And in the context of the trends of the market, sectors and other stocks..

This must be determined in an objective manner...

directly From the price and volume activity .

Step 1:

Determine the trend and the position within that trend.

This step involves the use of certain trendlines

Both by their Use and by their reverse use.

Some of the things measured are the angle at which the trend is moving, the amount of progress being made on each drive up and drive down called the thrust and the measurement of the comparative strength, weakness and the adequacy of each correction.

Also position as defined by the Wyckoff concepts of overbought and oversold. (and He is Not talking about ANY oscillator like a RSI etc..)

At the heart of Wyckoff's method is the concept of Action and Test. Action and Response. If we see an Action We look to the response for the secondary test. A failed test a poor response Then a trade is doubtful. We look and wait for successful tests for positve responses..

We look for the line of least resistance to define itself and become obvious..

Such that after our entry

our real example explodes higher.

Wyckoff stated in the quote above that When We Judge that We should be making a long position We are looking esp at the down waves of activity

When you are looking for an opportunity to buy, watch for the DOWN waves in the market and in your stock.

By recognising That markets move in waves a Greater amount of insight is possible. We proceed from principles that are always correct in their application.. When We are clear We act, When We are not clear We wait ..

motorway

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 1

- Views

- 987

- Replies

- 12

- Views

- 2K