- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

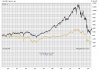

Re: XAO Analysis

has entered last parcel of BHP short at 35.5 .......... the bishop reckons im off my nut for fighting a trend but he aint got god on his side

has entered last parcel of BHP short at 35.5 .......... the bishop reckons im off my nut for fighting a trend but he aint got god on his side

I'm not economically literate.

I'm not economically literate.