- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Re: XAO Analysis

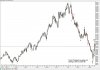

Speaking of EW, For those who are interested, the XAO is at a very interesting juncture. Since Nov 07, it has traced out x2 impulse (5 waves) waves separated by (a)-(b)-(c) correction that started in mid-march. Hence the overall move downwards from Nov 07 could be considered completed if it's viewed as a large correction. However, if the current Sep lows are broken (labeled as b), then wave iii of (iii) will be underway (down) and will be very aggressive indeed as almost all wave 3s are. The current Wave ii correction up appears to be tracing out an expanded flat (not unusual in wave 2 positions) that should complete the c portion of wave ii with 5 small waves up to fib resistance levels.

Speaking of EW, For those who are interested, the XAO is at a very interesting juncture. Since Nov 07, it has traced out x2 impulse (5 waves) waves separated by (a)-(b)-(c) correction that started in mid-march. Hence the overall move downwards from Nov 07 could be considered completed if it's viewed as a large correction. However, if the current Sep lows are broken (labeled as b), then wave iii of (iii) will be underway (down) and will be very aggressive indeed as almost all wave 3s are. The current Wave ii correction up appears to be tracing out an expanded flat (not unusual in wave 2 positions) that should complete the c portion of wave ii with 5 small waves up to fib resistance levels.