- Joined

- 23 March 2005

- Posts

- 1,943

- Reactions

- 1

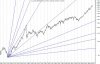

Re: XAO Analysis

Just a question from a guy who's having a stab at T/A

does today's XAO chart show a cup and handle formation??

Just a question from a guy who's having a stab at T/A

does today's XAO chart show a cup and handle formation??