The focus on digital health has become a global trend.

The long-term benefits of technological adaptation in this space will most likely be a reduction in unnecessary use of health services, alleviating the burden on undermanned or under resourced health providers, reduced costs and better, more efficient patient care.

Global Market Insights estimates the global digital health market to be worth US$639B in 2026 and outlines several growth drivers, including the rising adoption of smart devices, improving healthcare IT infrastructure, favourable government regulations and initiatives, and rising demand for remote patient monitoring services.

The factors have been at the forefront of OneView Healthcare plc’s (ASX:ONE) thinking.

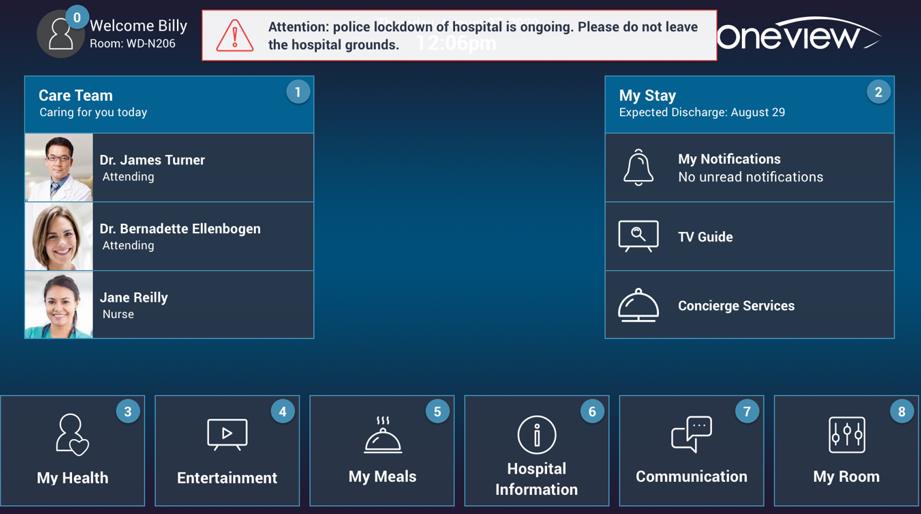

ONE is a health tech company that provides hospital patients a “virtual care and digital control centre” at their bedside to deliver the best possible patient experience during their stay.

Its software (SaaS) platform is sold as a yearly license fee per hospital bed, with the pandemic accelerating the uptake of this platform.

In fact its control centre, is currently used in 9,259 hospital beds around the world, including three of the top 20 hospitals in the USA.

ONE’s tech provides patients with a single touch screen at their hospital bed where patients can:

- Have virtual consultations with relevant medical specialists – local and from around the world

- Control all aspects of their room (bed, lighting, temperature),

- Order food, watch movies, get a nurse’s attention (think airline business class screens)

- Interact with tailored rehab, education and training videos for YOUR health situation, and;

- Monitor your health outcomes – Doctors and nurses have better info on you.

A single point of care

ONE was founded as a software and solutions business operations in 2008, with the objective of enabling healthcare organisations to make use of technology to drive cost efficiencies, improvements in clinical outcomes and enhanced patient satisfaction.

The idea was to create an experience leading to overall excellence in healthcare economics and quality of care.

For patients, ONE offers digital tools to help control their experience with virtual care at the bedside. ONE delivers a SaaS experience that transcends current in-room technology.

For the care team, optimisation of patient flow and patient experience becomes more personalised and engaging.

Effectively, Oneview offers a secure, flexible and scalable platform where the digital infrastructure for content, apps and services is at one point of care.

Uptake proves uplifting for ONE

Given the uptake and interest in the ONE solution, the company has delivered on many key metrics.

Highlights include:

- Expanded global footprint – live beds up 9% YOY to 9,259

- Recurring revenue up 13% to €5.1M, reflecting expanded user base despite short-term impact to recurring revenue growth as COVID-19 delayed scheduled deployments

- Improvement across key operational performance metrics, delivering reduced cash burn and cost

- Significant progress on product development–central to growth strategy including investment in next generation platform

- Process improvements and engineering offshoring

- Material improvements in productivity

- Enabling rapid delivery of the first cloud solution, Cloud for COVID-19.

Further to this recurring revenue is up by 13% to €5.1m (A$8.0m) due to expansion of live beds.

Covid-19 did have one negative impact for ONE: it prevented access to hospital sites, delaying installation and the go-live increase rate.

This is is expected to normalise in 2021.

Overall, the company has delivered higher gross margins. Gross profit margins improved 67% (up from 60% in FY19) due to changing revenue mix towards higher margin software recurring revenue.

The company had also enjoyed improved operational performance due to a focus on cost control. It has reduced operating expenses by 44% and improved operating EBITDA by 60% to a loss of €6.2m (A$9.7m).

There is also reduced cash burn and the cash balance of €6.8m (A$10.6m) reflects the €4.8m (A$8.7m before costs) capital raise conducted in Nov/Dec 2020 and the significant reduction in operating cash burn.

Interestingly, ONE currently has $7.85M in Annual Recurring Revenue (ARR) and is projecting 45% growth this year. However, this does not factor in any future revenue from Samsung.

Samsung sees the value of ONE’s technology

ONE signed a Distribution Agreement with Samsung SDS America, Inc., the enterprise IT solutions provider of Samsung, to offer a bundled solution for bedside digital services for patients in the United States.

The agreement went live in February this year.

Samsung SDSA will bundle Samsung tablets with Oneview Cloud Start –the first tier in Oneview’s new product suite.

The bundle will be distributed to healthcare-enterprise focused enterprise resellers.

“Our move to the cloud accelerates speed to market and opens new possibilities for distribution, making it faster, easier and lower-cost for end-customers to benefit from the digital platform at the bedside,” ONE CEO James Fitter said.

“Never has this need been so apparent. Our partnership with Samsung provides a unique opportunity to address new virtual models of care and provide the solution for Samsung SDSA to enhance the value proposition for their reseller network.”

The agreement is designed to continue the improvement in US healthcare, in particular patient care.

Mingu Lee, Chief Business Officer and Senior Vice President, Samsung SDS America, said “Our distribution partnership with Oneview Healthcare enables us to deliver a more cost-effective and impactful solution, allowing caregivers to work efficiently while providing a connected experience for patients.”

The agreement not only opens up further revenue streams for ONE, but also provides customers with an upgrade path to ONE’s Cloud Enterprise tier with additional features.

Strategic partnerships including its Samsung agreement and an agreement with Microsoft, Cloudbreak and Caregility, with whom it entered a partnership to enable customers to scale inpatient telehealth across the enterprise as the COVID-19 pandemic continued to ravage Dublin, Ireland, continue to define ONE’s go to market strategy especially in the US where there are 6000 hospitals.

ONE’s full SaaS platform is anticipated by the end of Q1 2021.

ONE is trading at 21.5 cents.

Disclaimer: This article is sponsored content from OneView Healthcare plc (ONE) and does not constitute an endorsement by the publisher