88 Energy Ltd (ASX:88E; AIM:88E) this week executed its drilling contract to drill the Merlin-1 and Harrier-1 wells for Project Peregrine on the North Slope of Alaska.

In fact, the Alaska North Slope is home to the US’s largest two oil fields and it hosts some of the world’s largest discoveries over recent years, featuring both onshore and conventional (not shale) with enormous potential.

With excellent infrastructure and low royalty rates it is a good place to do business.

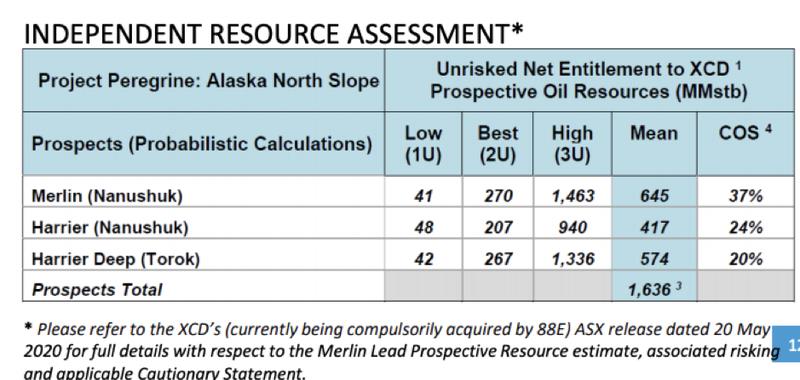

Project Peregrine has a 1.6 billion barrel mean unrisked recoverable prospective resource, located on trend to recent discoveries, including one by oil super major ConocoPhillips (NYSE: COP).

The project has multiple compelling targets, that are shallow to drill test – which means relatively low cost drilling.

An independent resource assessment arrived at an unrisked prospective oil resource of over 1.6 billion barrels at Project Peregrine, across three prospects, two in the Nanushuk formation (Merlin and Harrier), with a Harrier Deep prospect located in the deeper Torok formation.

Recent further seismic analysis increased the company’s confidence at the Project, which identified several similarities between 88E’s Merlin and Harrier prospects and existing discovered oil fields nearby.

Merlin-1 drilling is imminent

88E is on track for its scheduled spud date of the Merlin-1 well February 2021, which is planned to be drilled to a total depth of 6,000 ft, and aims to intersect the shallower Nanushuk topset horizons listed above.

88E recently confirmed a farm out partner who will contribute US$11.3M toward the cost of the Merlin-1 well, and earn 50% of the Project. The estimated gross cost is US$12.6M.

88E’s farm-out partner is the Alaska Peregrine Development Corporation LLC (APDC), a high calibre group of private US individuals that have experience in oil and gas, including owning businesses that directly operate in the sector.

88E only needs to contribute US$1.3M, representing its 50% ownership share over and above a US$10M carry. All additional costs associated with the project above the US$10M carry will be borne equally by both and 88E.

This is a good deal for a small cap oil explorer like 88E, as it allows the company to retain 50% of the upside of drilling success, without having to outlay a large sum for drilling. It is close to a 2 for 1 deal for 88E investors and effectively gives 88E a low cost shot at a potentially large oil discovery early next year.

88 Energy has executed a rig contract with All American Oilfield, LLC for the use of Rig 111 to drill the Merlin-1 and Harrier-1 wells at its Project Peregrine in the NPR-A region of the North Slope of Alaska.

Managing director Dave Wall said of the spud, “The farm-out was finalised late last week and now the rig contract is executed.

“Drilling at Project Peregrine is moving ahead as planned and we are only three months away from spud on what will be a potentially company-making prospect for our shareholders.”

Pantheon’s spud could propel 88E forward

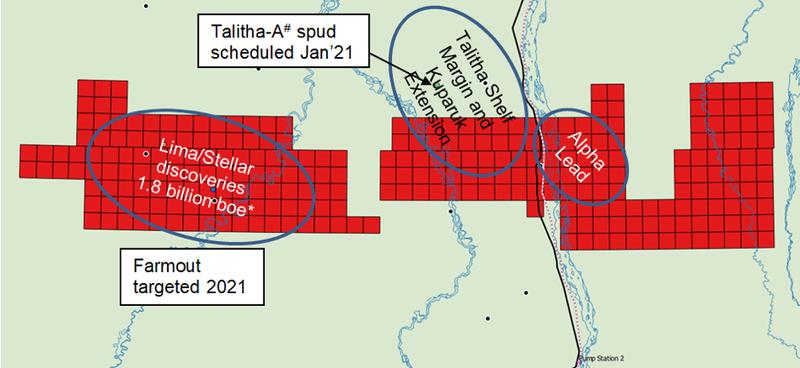

88E operates the majority of the vast 475,000 acre Project Icewine, targeting oil on the world class North Slope of Alaska. The company’s goal is to build a successful exploration and production company that delivers material benefits to its shareholders and contributes to the development of the regions in which it works.

Within the region is the £211 million (AU$380) Pantheon Resources (AIM: PANR), which will spud its Talitha-A well, located close to the northern border of the 88E central acreage position, in January.

Several of the prospective horizons in Talitha-A are interpreted to extend into 88E acreage as indicated below.

As Pantheon’s drilling is ahead of the Merlin-1 spud, 88 Energy’s share price could receive some support for 88E, increasing the perceived value of Project Icewine’s real estate.

Support for 88E is already strong

88E has found strong support in the December quarter, with liquidity in the stock building as interest in its drilling plans grows.

The company was trading between A$0.005 and A$0.006 in late September, and since then has raised A$10M at A$0.006 per share.

The stock has traded as high as A$0.009 in late November.

News of the spud and farm-out should provide further momentum with significant near-term catalysts in the lead up to the spudding of the Merlin-1 well. A significant oil discovery would drive a substantial rerating of 88E.

Disclaimer: This article is sponsored content from 88 Energy Limited (88E) and does not constitute an endorsement by the publisher.