A very LAZY End of Day system, between 5-7 trades triggered a year.

Average holding time for a winner over 400 days.

Id be very grateful to get any feedback and construstive criticisms.

If you wouldnt trade it -- why not?

And in which ways can it be improved?

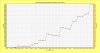

There is a 2-year period in which the system made no money at all (1995-1997 see monthly return chart) -- Is this acceptable?

The testing period is 10 years, 1992 until 2002, over the entire ASX market.

Average holding time for a winner over 400 days.

Id be very grateful to get any feedback and construstive criticisms.

If you wouldnt trade it -- why not?

And in which ways can it be improved?

There is a 2-year period in which the system made no money at all (1995-1997 see monthly return chart) -- Is this acceptable?

The testing period is 10 years, 1992 until 2002, over the entire ASX market.